Future of Finance

How can future-casting and behavioral research give financial businesses an edge on tomorrow’s opportunities?

Future of Finance

How can future-casting and behavioral research give financial businesses an edge on tomorrow’s opportunities?

Future of Finance

How can future-casting and behavioral research give financial businesses an edge on tomorrow’s opportunities?

Design research using speculative scenario development and behavioral experiments to uncover signals of future demand.

With the financial industry in a state of flux, it’s imperative for its leaders to read change, uncover opportunities, and lead action. Challenger businesses have proven to be powerful disruptors – but even they face threat of failure from the tides of changing customer behavior. I led a team of strategic design researchers through a process rooted in speculative design, identifying trends, projecting customer behaviors, and uncovering new possible service opportunities of finance in the future.

This project was initiated to build a foundation for rich conversations and collaboration opportunities between the EVRY’s Strategic Design Lab and Nordic financial service providers. It has helped bolster EVRY’s credibility in using strategic design to differentiate.

Client

EVRY Strategic Design Lab

Date

2018

Role

Project Lead

Type

Strategic Design

Speculative Design

Design Research

Overview

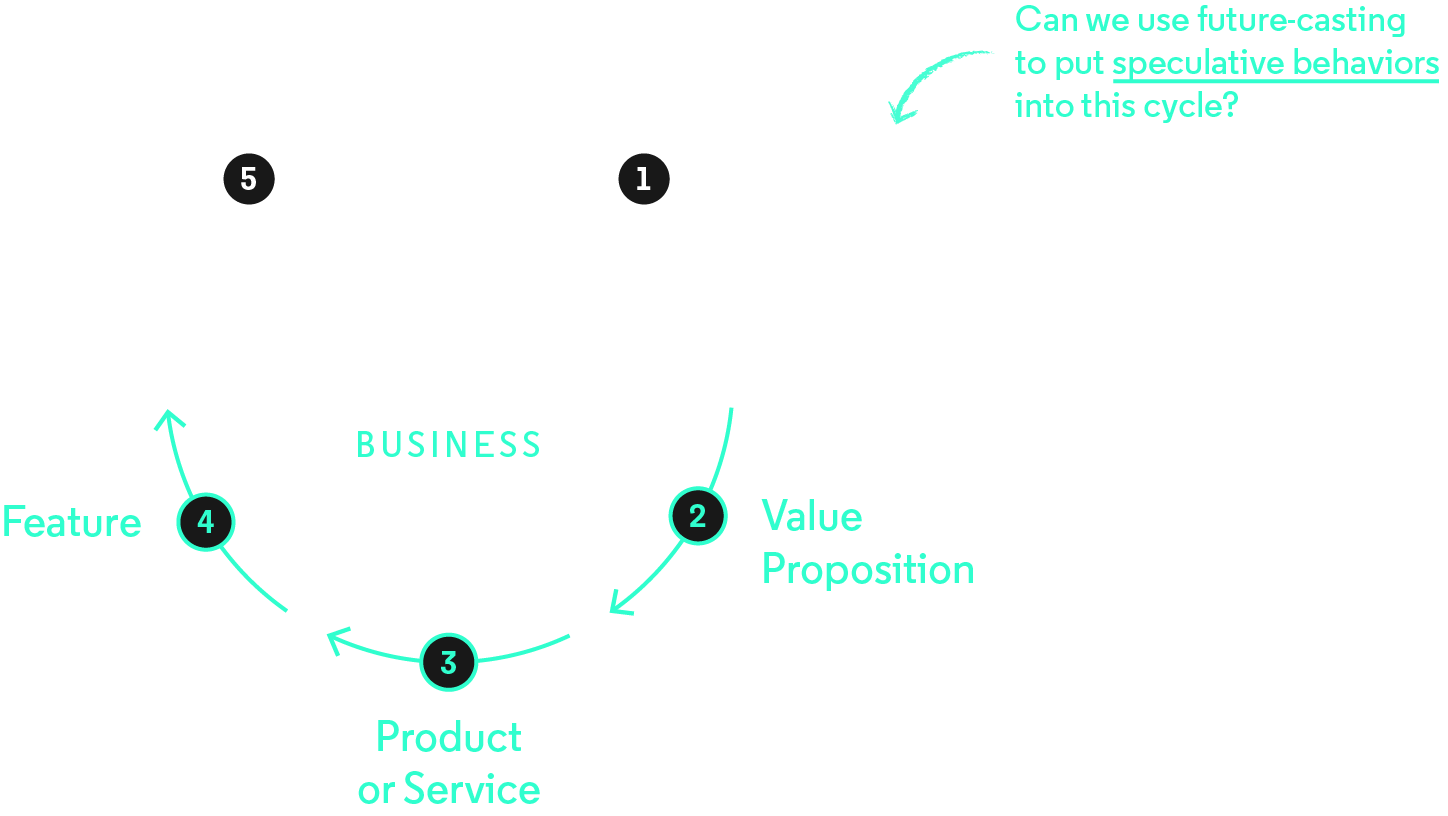

Investigating possible behaviors of the future

The most successful products and services we rely on today are responses to existing or emerging human behaviors – but what about the future behaviors we can’t measure yet? Fundamentally, this project asked if it was possible to capture signals of change in the present to explore possible future behaviors and design responses to them.

Research Approach

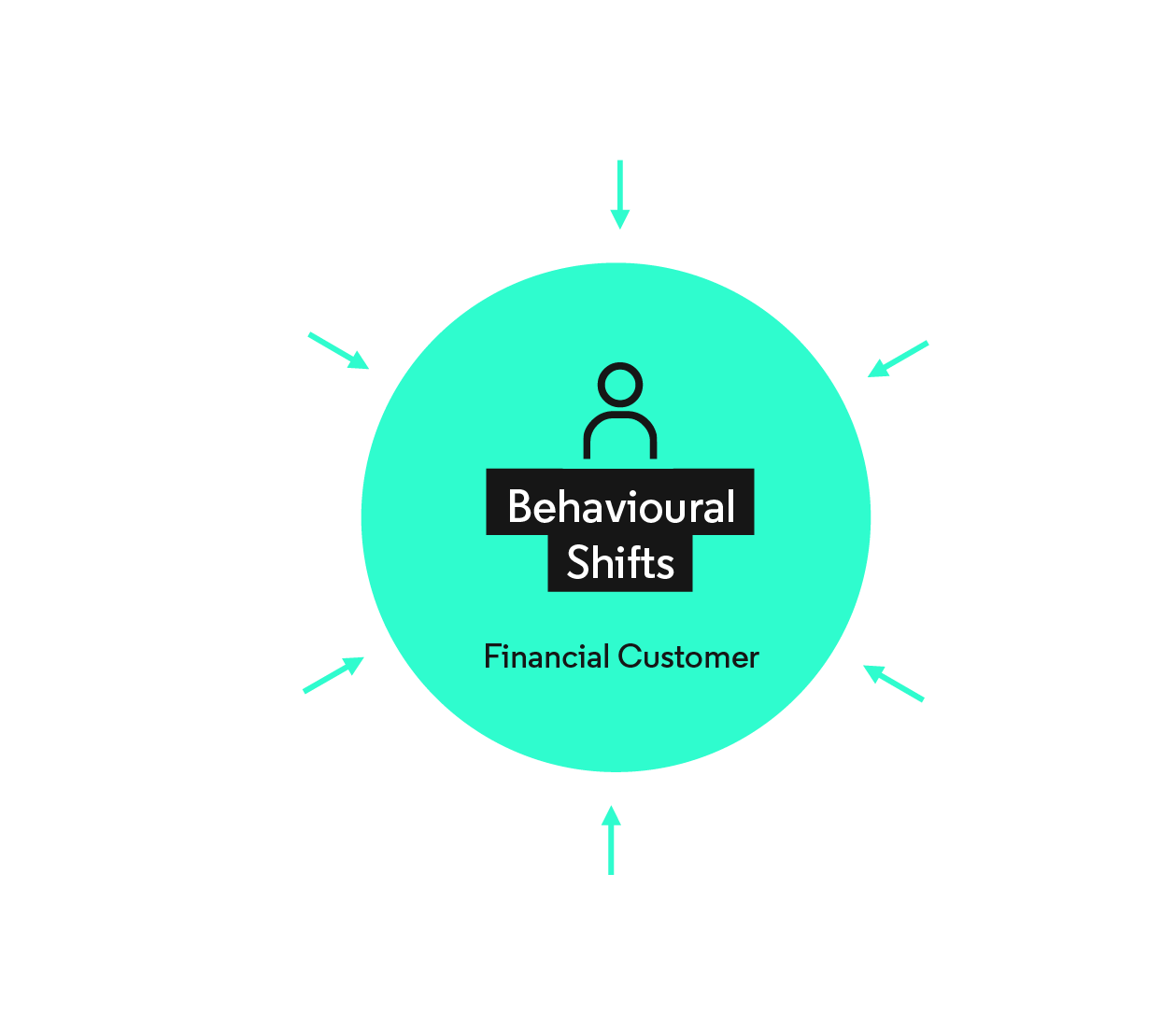

Identifying the forces that shift behavior

As the glue that connects industries together, the finance industry must understand the new customer demands and expectations driven by other macro-environmental factors that shift customer behavior. We hunted for trends in 6 categories, searching for signals of changes in people’s perceptions of value.

Speculative Design

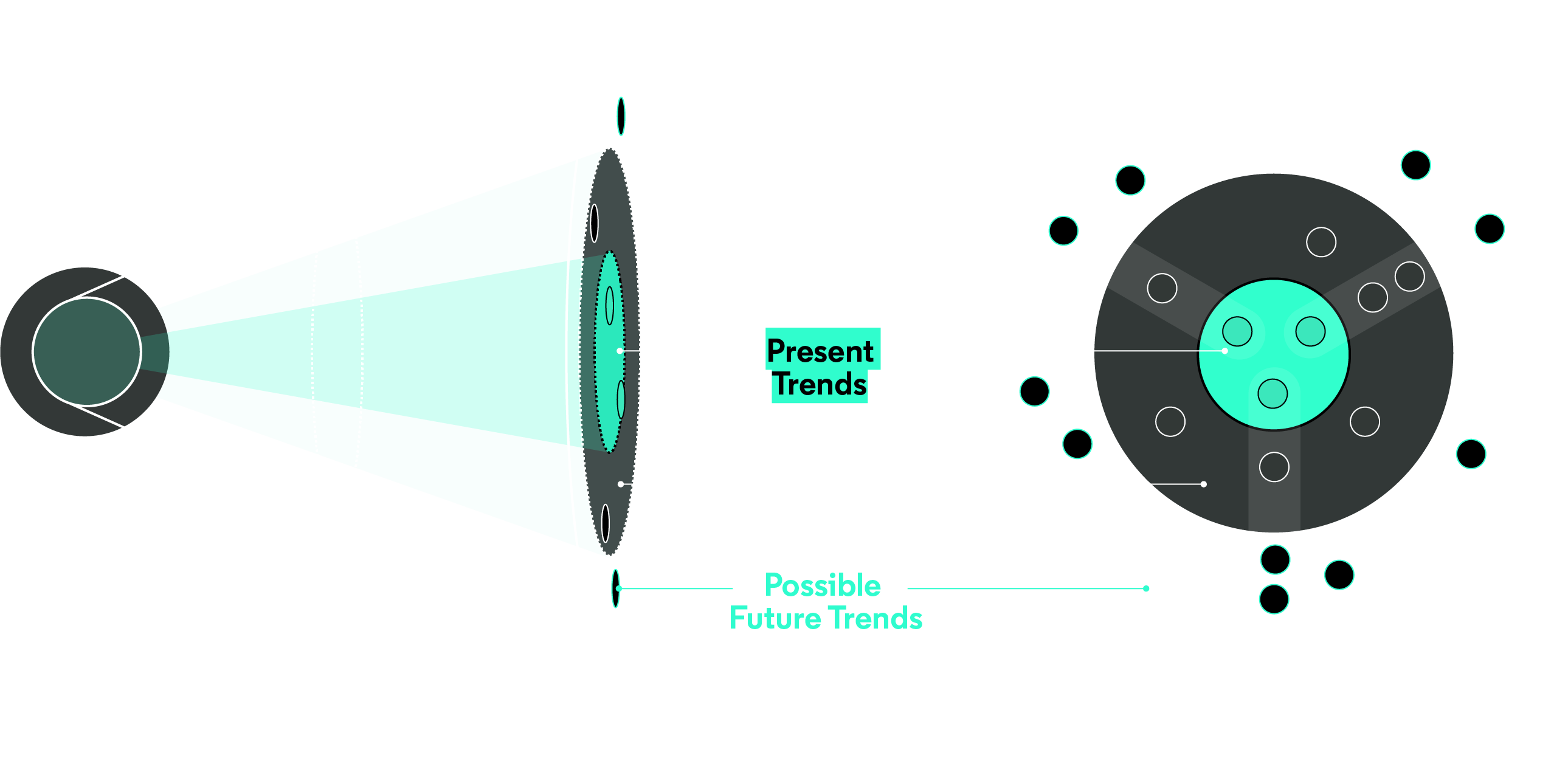

Projecting possibilities through future wheels

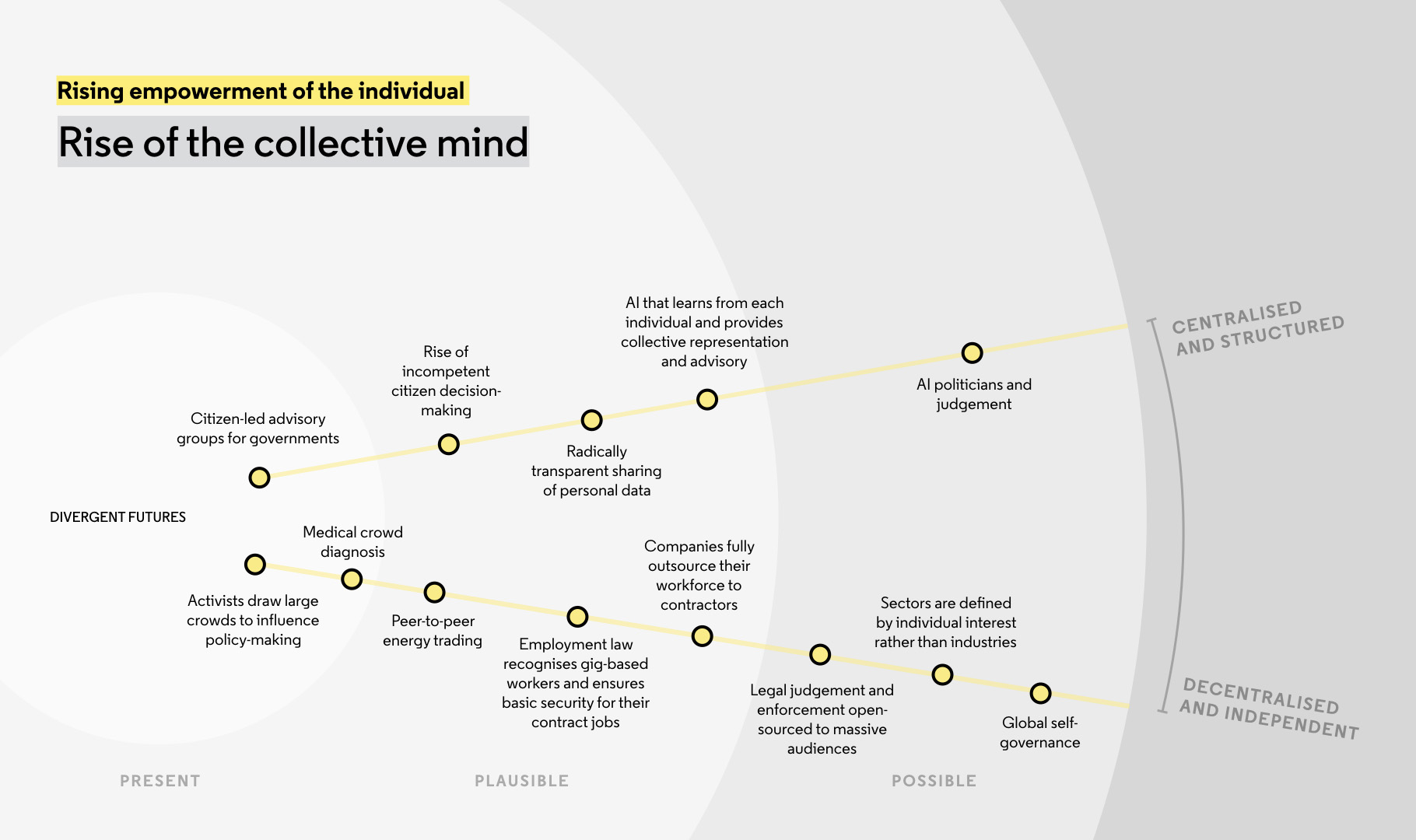

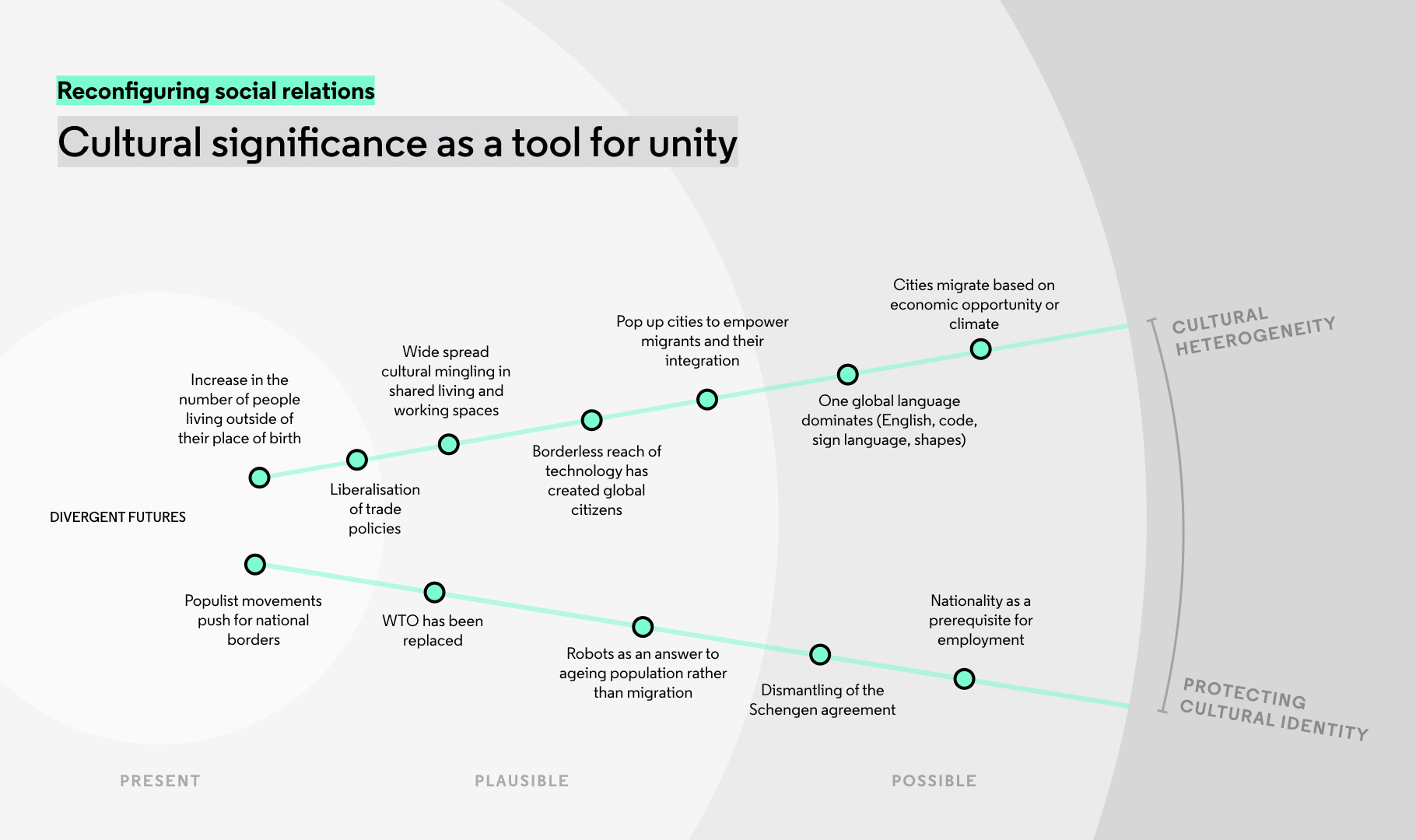

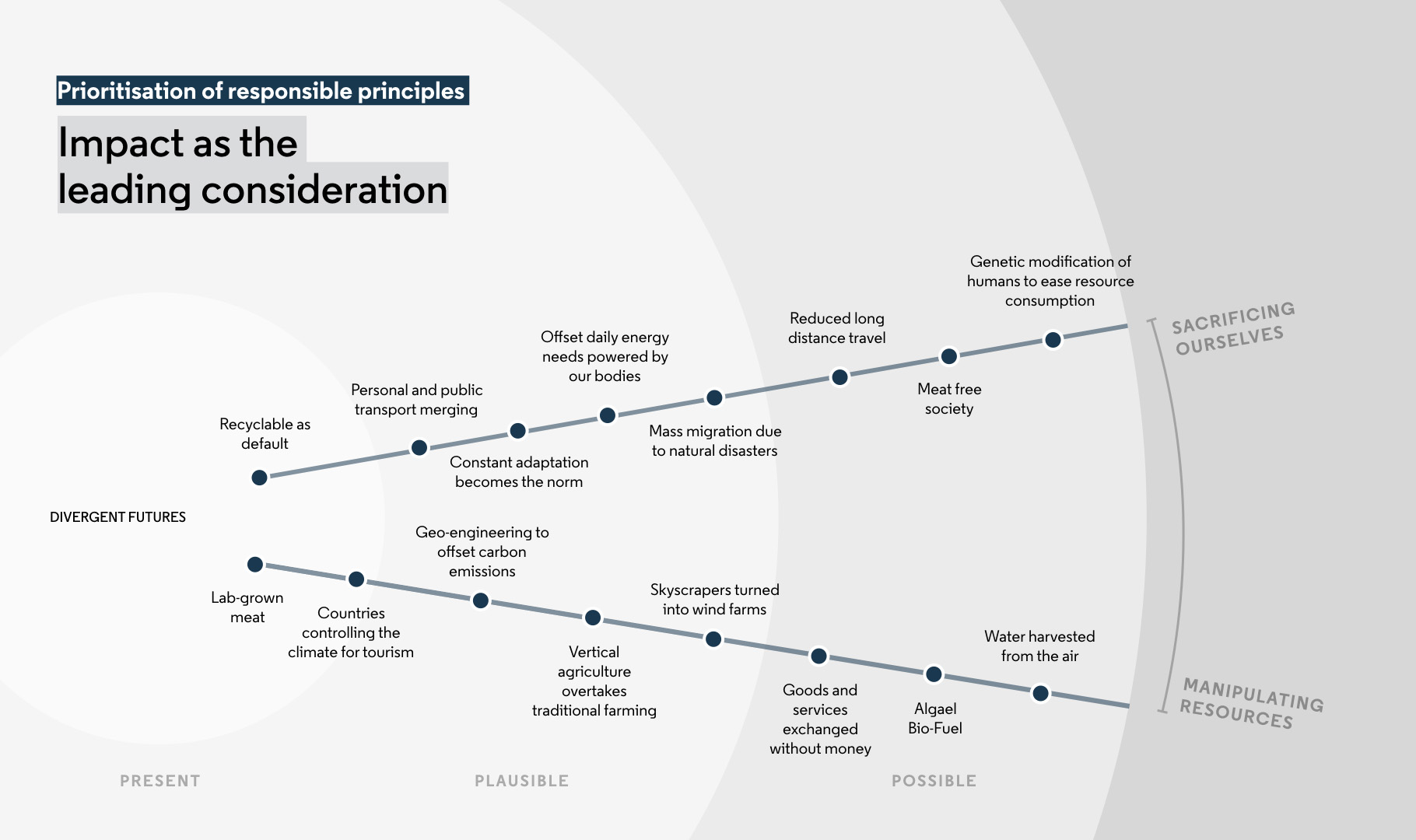

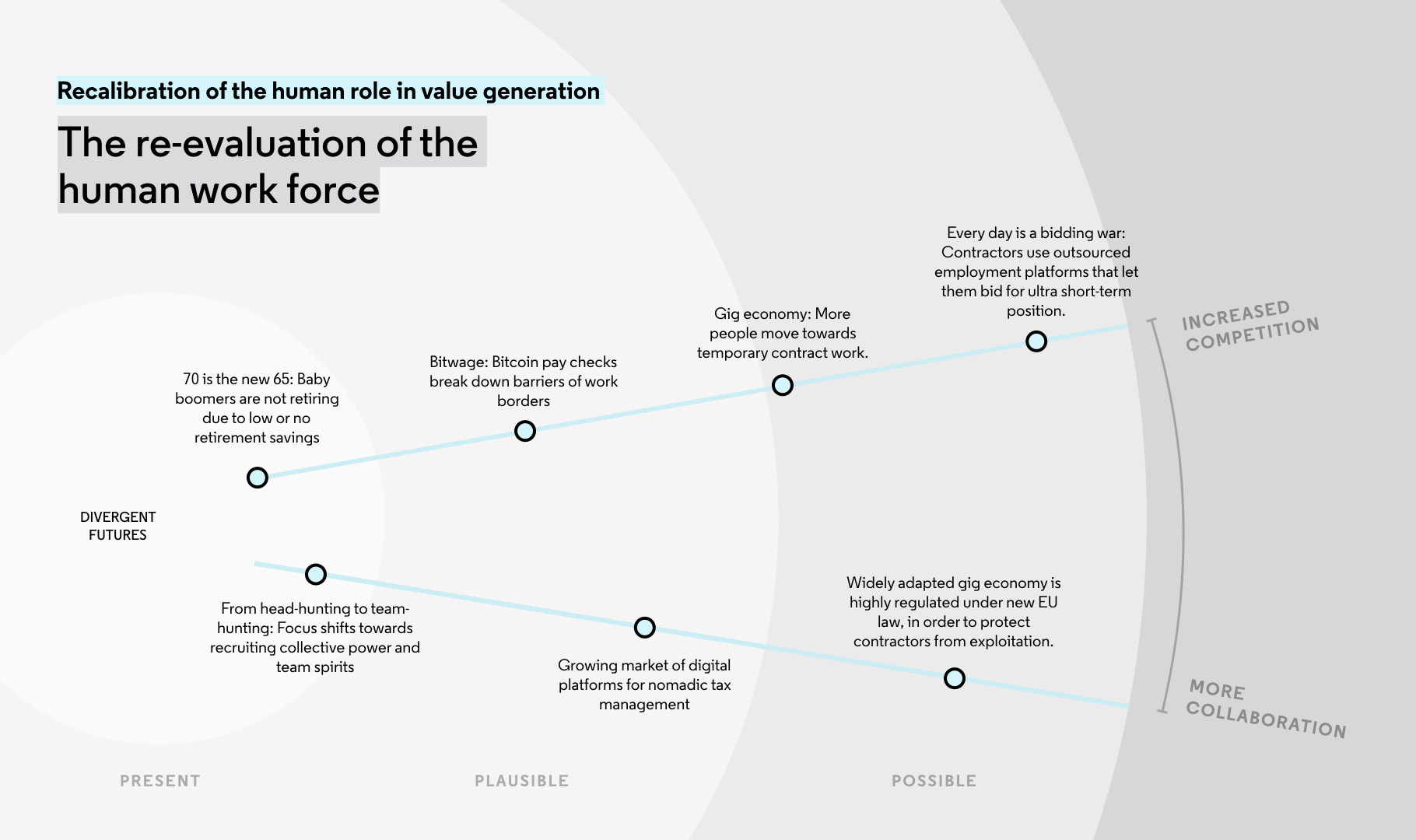

We analyzed and organized the trend anecdotes into 4 core themes, painting a broad picture of the directions in which society might move towards. We used this snapshot of today to project into plausible and possible futures. We created focused narratives by establishing tensions within each theme, intentionally designed to be at odds with each other in order to fully investigate the theme.

These theme map snapshots demonstrate present, plausible, and possible events mapped on the future cone.

These theme map snapshots demonstrate present, plausible, and possible events mapped on the future cone.

Exploratory Workshops

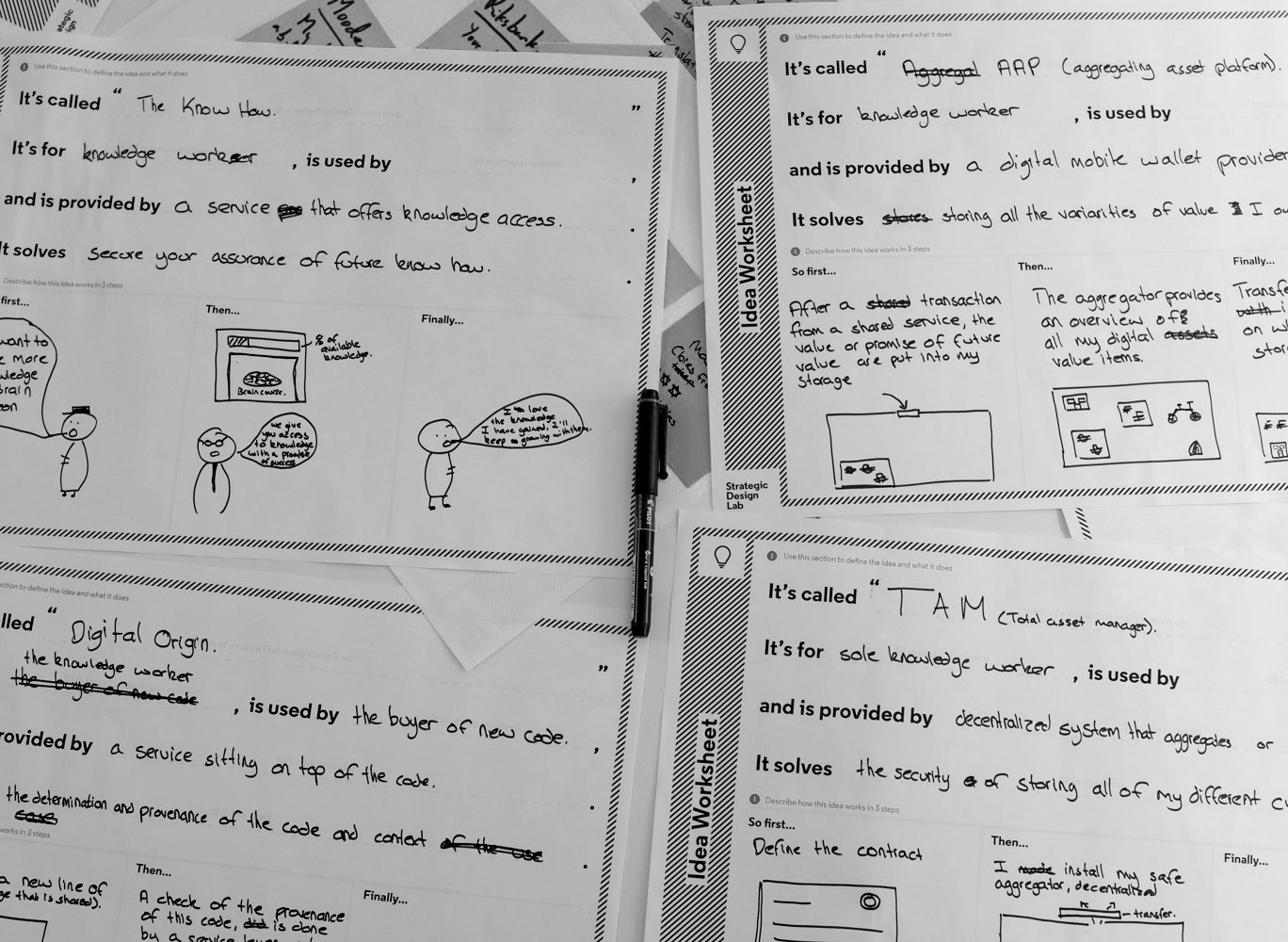

Toolkit for creative value proposition exploration

Using the 30+ future narratives, we developed a Scenario Fragment Framework to facilitate ideation about the future. We hosted co-creative workshops with diverse participants. Groups selected random scenario fragments and were challenged to develop snapshots of future societies by inventing stories about Retail, Environment, Politics, Media, Transport, Education, and other fundamental topics. By the end, groups were developing new value propositions for financial services to serve their newly invented realities.

Framing for reality

Finding opportunities from shifting perceptions of value

The workshops helped to illuminate possible shifts in perceptions of value. We formed a number of hypotheses and selected three of them to test with short behavioral experiments.

The future of value lies in...

The future of value lies in...

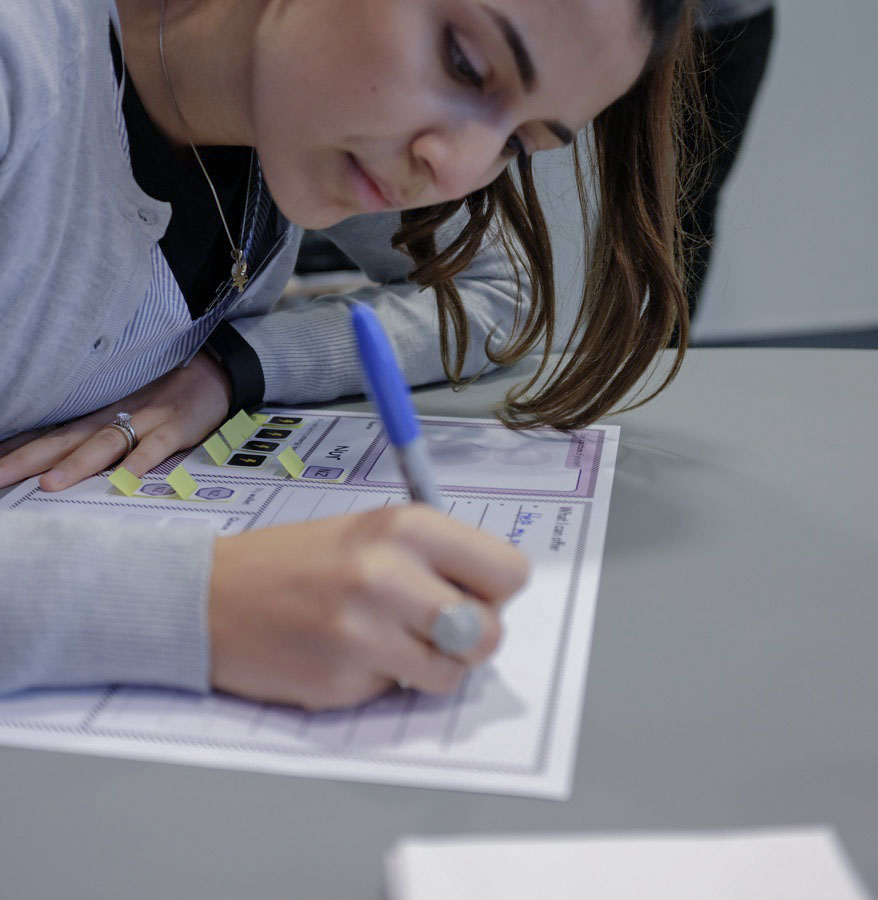

Behavioral experiments

Testing future hypotheses through the lens of today’s behaviors

We developed 7 short experiments to capture reactions to our hypotheses about the future of value. Experiments ranged from guerilla marketing campaigns to group games played amongst strangers. These experiments were only small tastes of the behavioral research possible to interrogate these hypotheses, but served to show value in this type of effort.

Guerilla Street Study

Guerilla Street Study

Under the guise of a new startup “Scorilla”, we collected opinions and the underlying understanding of what trust means in our digital age to people from all parts of society.

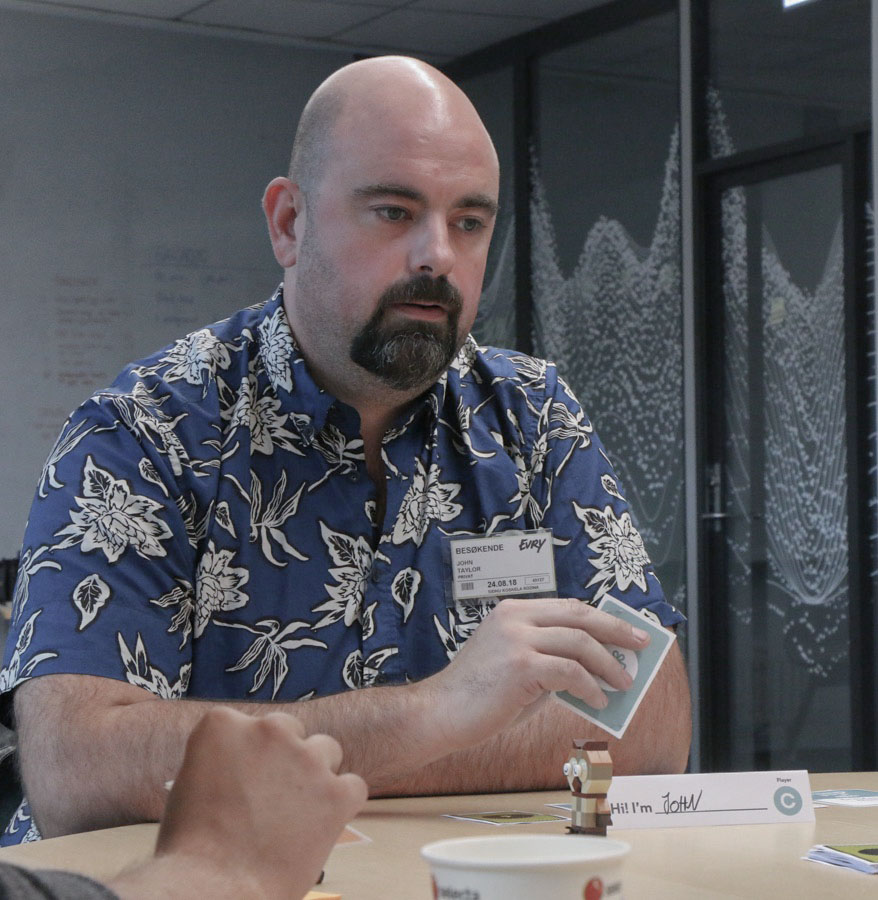

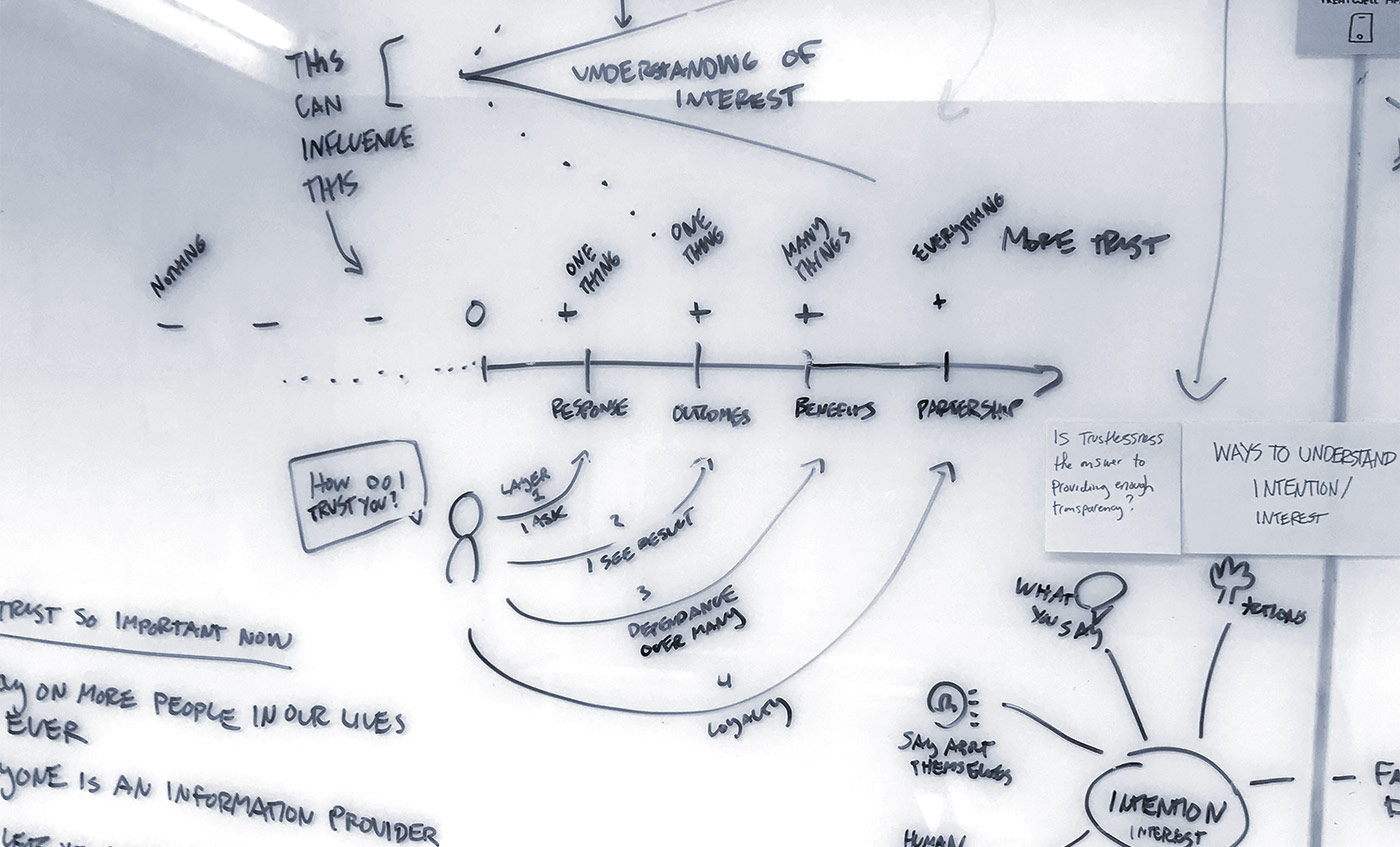

Trust Negotiation Game

Trust Negotiation Game

Trust Negotiation Game

We designed a three-player game with real incentives to explore which factors allow people to trust and be trusted amongst a group of strangers with complex interests.

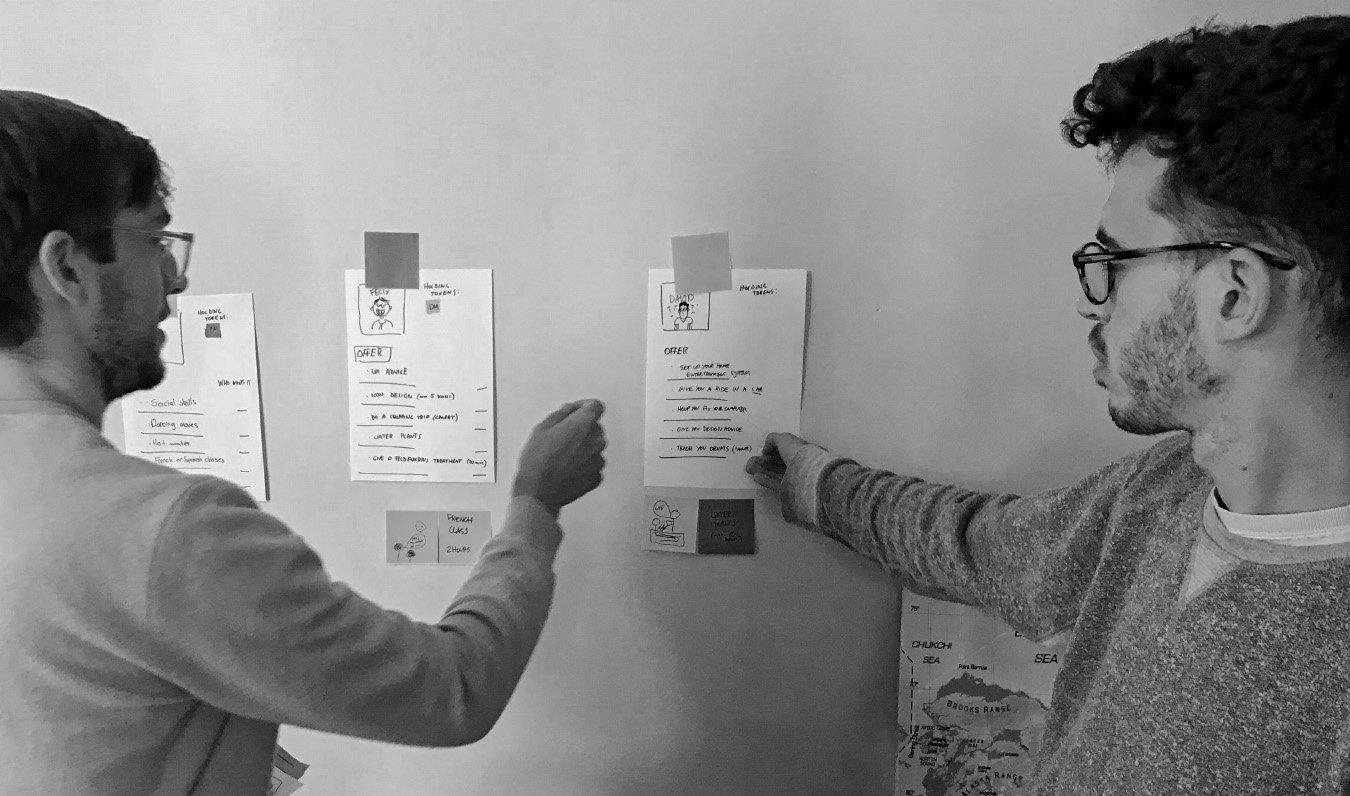

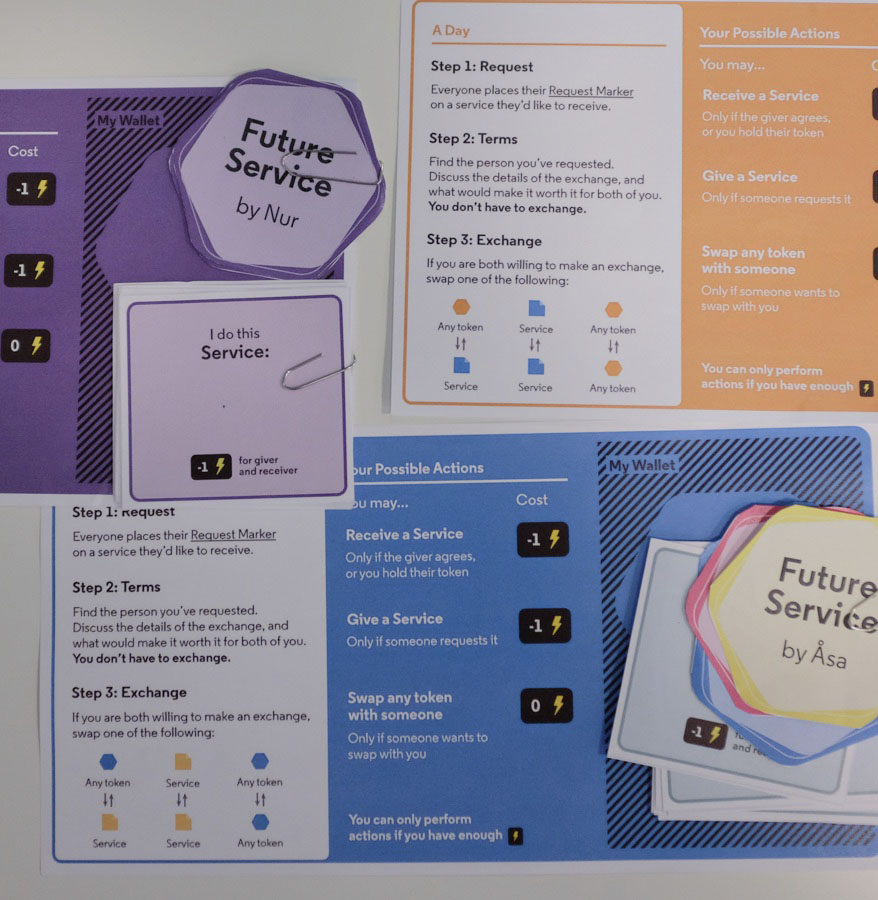

Service Trading Simulation

Service Trading Simulation

Service Trading Simulation

We designed an economic simulation to examine a non-monetary service-based marketplace in practice to see how people in the Nordics react to drivers like fairness, valuation, and competition.

Concept Development

Developing possible financial services of the future

Using the insights gathered from our experiments, we built three conceptual financial services to exemplify the opportunities. We gathered emergent questions to help fuel conversations with leaders in the financial industry.

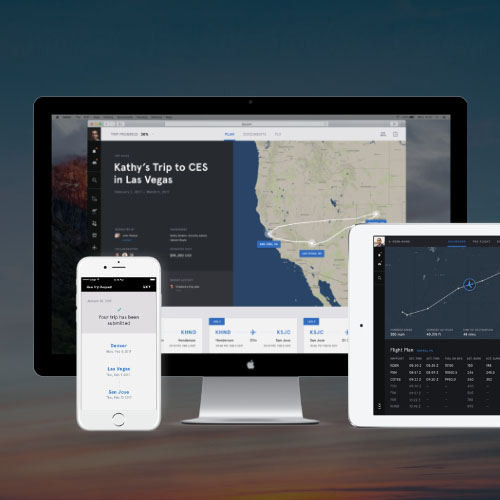

The Lifestyle Bundle

The Lifestyle Bundle

Siv is a concept that envisions banks to be an active financial orchestrator between consumers and brands.

Emergent Questions:

If access models reduce the tangible aspect of money, what will consumers need in order to feel in control of their spending?

Could lifestyle bundles augmented pay checks from your employer?

Intermediaries of Trust

Intermediaries of Trust

Intermediaries of Trust

WeScore is a payment concept that establishes banks as trusted and informative intermediaries between payment partners for more than just financial security.

Emergent Questions:

Alongside a reliable and “trustless” technology, what is needed to make trust a tangible part of a purchase?

Alongside a reliable and “trustless” technology, what is needed to make trust a tangible part of a purchase?

What are the potential ethical implications of measuring and intermediating trust?

What are the potential ethical implications of measuring and intermediating trust?

The No-Money Marketplace

The No-Money Marketplace

The No-Money Marketplace

Solid is a conceptual marketplace that helps people exchange highly customized services with each other without the use of a universal currency.

Emergent Questions:

How will perceptions about the role of work change in a world where value is exchanged in multiple new ways?

Are financial providers best suited to help guide individuals to generate their own value in a global marketplace?

Project Impact

This work has helped establish EVRY and its Strategic Design Lab as progressive thought leaders in the Nordic financial industry, and has been adapted for a range of other industries such as retail and public sector.

This work has helped establish EVRY and its Strategic Design Lab as progressive thought leaders in the Nordic financial industry, and has been adapted for a range of other industries such as retail and public sector.

This work has helped establish EVRY and its Strategic Design Lab as progressive thought leaders in the Nordic financial industry, and has been adapted for a range of other industries such as retail and public sector.

Aviation ClientProduct and Service Ecosystem

Connected FoodHardware Prototyping & Speculative Design

Logitech G HubProduct Design & User Validation

ScoutImmersive and Personalized Education

Surrounded by DataExploration of Future Interfaces & IoT

BIG20Physical Product Launch

RoomieIoT Connected Room Sign